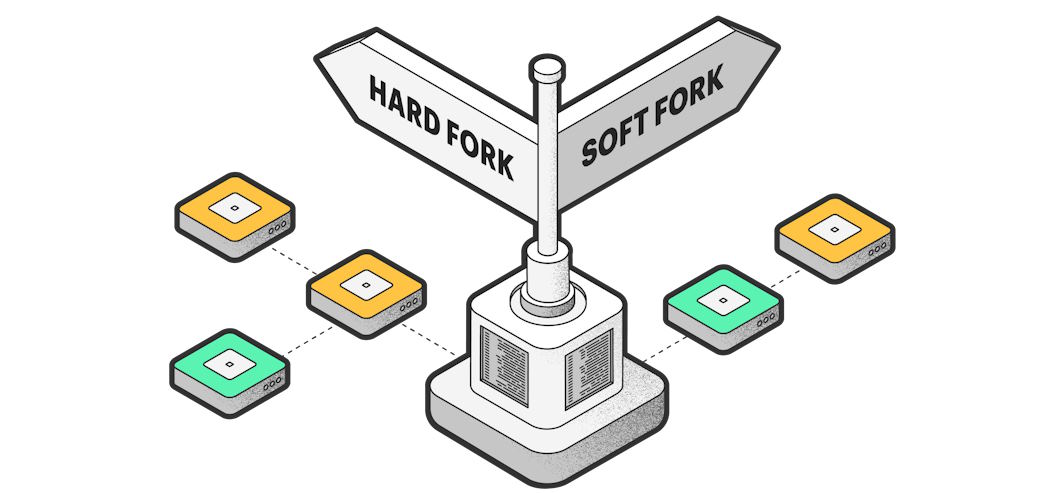

Cryptocurrency enthusiasts and investors have witnessed the transformative power of blockchain technology in the past decade. But with this innovation comes a unique phenomenon known as the cryptocurrency fork, a process through which a blockchain diverges into two separate chains. While forks can be a vital aspect of blockchain development, they also carry inherent risks that can profoundly impact cryptocurrency holders.

Risks Associated with Cryptocurrency Forks

Cryptocurrency forks, while often celebrated as catalysts for innovation, are not without their risks. In this section, we’ll explore the key risks associated with forks, highlighting the potential challenges they pose to cryptocurrency holders.

Chain split and network disruption:

- How forks can lead to a split in the blockchain: Cryptocurrency forks occur when the community and developers reach an impasse regarding a protocol update. This can result in a “chain split,” where the blockchain diverges into two separate entities, each following a different set of rules. This division can create confusion and competition within the network.

- Effects on transaction confirmation and security: Chain splits can disrupt the consensus mechanism and impact transaction confirmations. Users might experience delays or inconsistencies in confirming their transactions, while the security of the network may be compromised as miners and nodes choose sides in the fork, potentially leaving one chain more vulnerable to attacks.

Loss of consensus:

- How forks can divide the community and developers: Forks often lead to disagreements within the cryptocurrency community and its core development teams. These divisions can create tension, undermining trust and collaboration. A lack of consensus can also hinder the progress of the cryptocurrency, causing fragmentation and potentially diminishing its overall utility.

- Impact on the long-term viability of the cryptocurrency: The loss of consensus and the resulting uncertainty can have far-reaching consequences. If the community remains divided, it may be challenging to make necessary updates and improvements, which could threaten the long-term viability and success of the cryptocurrency.

Price volatility:

- How forks can affect the price of the original and new cryptocurrencies: Cryptocurrency forks can trigger price volatility. The introduction of a new chain can cause fluctuations in the value of both the original and the new cryptocurrencies. Holders may see their assets’ values swing dramatically, often with little predictability.

- Investor sentiment and market reaction: Price volatility resulting from forks can be influenced by investor sentiment and market reaction. Traders may rush to buy or sell based on their perception of the potential winner in the fork, leading to sharp price swings and an atmosphere of uncertainty in the market.

Impact on Cryptocurrency Holders

Cryptocurrency forks aren’t just events that occur in isolation; their consequences have a direct impact on the holders of the original and new cryptocurrencies, and they come with a host of decisions and considerations.

Holders of the original cryptocurrency:

- Changes in the value of their holdings: When a fork happens, the value of the original cryptocurrency often experiences fluctuations. This can lead to either gains or losses for holders, depending on market sentiment and which side of the fork gains more traction. These changes can be sudden and substantial, requiring vigilant monitoring.

- Decision-making: Hold, sell, or diversify: Original cryptocurrency holders face a crucial decision: hold onto their existing assets, sell them to capitalize on short-term gains, or diversify their holdings across both forks. Each choice comes with its own set of risks and potential rewards, making it a challenging decision that should be carefully considered.

Holders of the new cryptocurrency:

- Possibilities for gains or losses: Holders of the new cryptocurrency created through the fork have the potential for both gains and losses. If the new coin gains traction and community support, its value can increase. Conversely, if it fails to gain adoption, the new cryptocurrency may end up being worth very little.

- Considerations for trading or holding: Deciding whether to trade or hold the new cryptocurrency is a crucial step. Some holders may opt to trade it immediately for more established assets, while others may choose to hold in the hope that it appreciates in value over time. It’s a decision that hinges on market research and individual risk tolerance.

Long-term implications:

- How forks can shape the future of a cryptocurrency: Forks can fundamentally influence the direction of a cryptocurrency. The success of one chain over the other can determine the long-term viability and relevance of the original cryptocurrency. Holders must consider which chain aligns with their vision for the future.

- Deciding which fork to support: In the case of contentious forks, holders may need to decide which chain they want to support. This decision can be informed by various factors, including the development team’s credibility, the community’s consensus, and the technology’s potential.